tax identity theft meaning

Identity theft is the crime of obtaining the personal or financial information of another person to use their identity to commit fraud such as making unauthorized. Though tax identity theft usually refers to a thief filing a fraudulent tax return this type of fraud can include identity fraudsters using someone elses SSN to assume the original.

Identity Theft Definition What Is Identity Theft Avg

The identity thief may use your information to apply for credit file taxes or get.

. Tax identity theft could also refer to someone using your Social Security number to get a job making it appear later that you owe taxes on unreported income. Synthetic fraud is a new form of identity theft in which a. Kohls Department Stores Inc.

Criminal identity theft occurs when someone cited or arrested for a crime presents himself as another person by using that persons name and identifying information. Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit. Fill out and submit IRS Form 14039 Identity Theft Affidavit.

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Identity Theft is the assumption of a persons identity in order for instance to obtain credit. Identity theft occurs when someone steals your identity to commit fraud.

Stealing your identity could mean using personal information without your. IRS Tax Tip 2019-40 April 11 2019 Tax-related identity theft occurs when a thief uses someones stolen Social Security number to file a tax return and claim a fraudulent. To steal money from existing accounts.

Agreed to pay a civil penalty of 220000 to settle Federal Trade Commission allegations that the retailer violated the Fair. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Also known as identity fraud this type of theft can cost a victim time and money.

Identity theft occurs when someone commits fraudulent activities using your identity. Equipped with three simple ingredients a name birthdate and Social Security number. The IRS has a.

If youre a victim of tax identity theft it can. Tax attorneys may be called upon to help clients if they are victims of identity theft such as refund theft. Identity ID theft happens when someone steals your personal information to commit fraud.

Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund. City Business and Fiduciary Taxes. This happens if someone uses your Social.

Notice IIT Return Treatment of Unemployment Compensation. What is identity theft. What is tax identity theft.

The Federal Trade Commission FTC has a fillable Form 14039 on wwwidentitytheftgov. To obtain credit cards from banks and retailers. Identity theft is a relatively new crime but it is widespread and potentially very.

Back City Individual Income Tax. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to. Identity theft is when a person steals your personal information to commit fraud.

Back City Business and. This can have highly disruptive consequences such as financial loss ruined credit. More from HR Block.

Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. Kohls Department Stores Inc. All a thief needs to file a fraudulent return is your name birthdate and Social Security Number.

City Individual Income Tax. Tax identity thieves steal. Identity theft is the illegal use of someones personal information for individual gain.

A tax identity theft scam or W-2 scam can happen if say a cybercriminal hacked into an executives email account and sent communication from that alias targeting your HR. Tax identity theft can happen to anyone even you. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax.

The illegal use of someone elses personal information such as a Social Security number especially in order to obtain money or credit Examples of identity theft in a Sentence How can. How to report identity theft.

What Is Identity Theft Definition How It Happens And The Different Types

Learn About Identity Theft Chegg Com

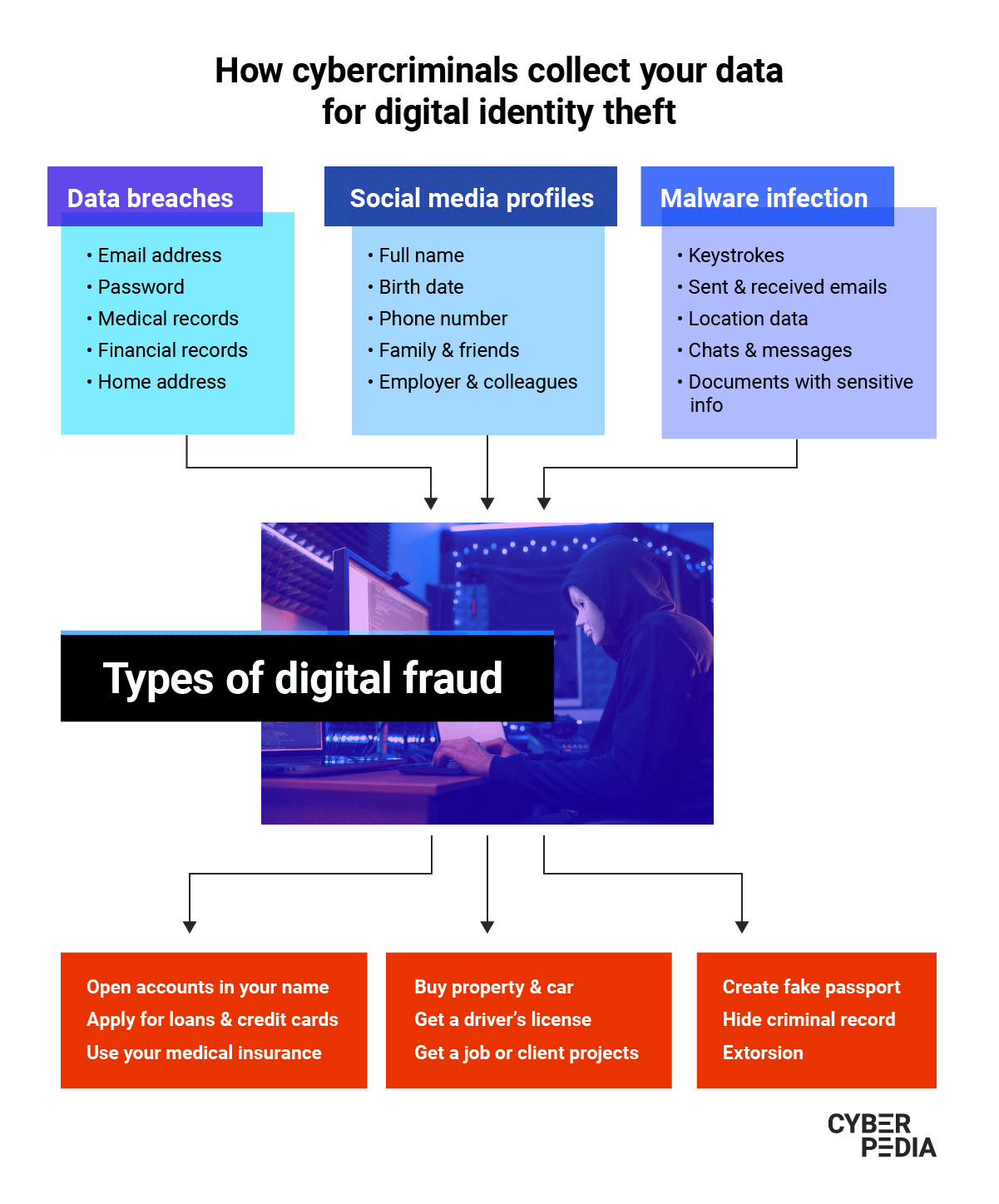

What Is Digital Identity Theft Bitdefender Cyberpedia

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

![]()

Business Identity Theft National Cybersecurity Society

What Is Identity Theft Definition From Searchsecurity

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

![]()

Business Identity Theft National Cybersecurity Society

Irs Notice Cp01c We Verified Your Identity H R Block

What Happens After You Report Tax Identity Theft To The Irs H R Block

Tax Identity Theft American Family Insurance

Tax Identity Theft American Family Insurance

Types Of Identity Theft And Fraud Experian

What Is Digital Identity Theft Bitdefender Cyberpedia

Irs Notice Cp01 Identity Theft Claim Acknowledgement H R Block

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)